More Salary or a Pension Plan: Which is better?

This article was originally published in CanadianSME Small Business Magazine on November 11, 2024.

In an increasingly competitive job market, attracting and retaining skilled workers has become more challenging than ever. Hard-to-fill positions include electrical and aerospace engineers, software developers, construction workers, financial advisors and heavy equipment mechanics – just to name a few. Employers often try to attract and retain employees by offering higher wages, hoping that higher pay will be the deciding factor in luring top talent.

While salary increases provide immediate financial benefits, they don’t offer the long-term financial security that many employees want. For skilled workers, a job is more than just a paycheque: they’re looking for a sustainable career path that leads to a financially-secure retirement. In a recent HOOPP/Abacus Survey, 70% of workers reported they would change jobs for a pension plan. By offering a pension program, employers can attract and retain the best employees with something they value more than a salary bump: an investment in their future.

70% of workers will change jobs for a pension plan.

Salary vs. Pension: Crunching the Numbers

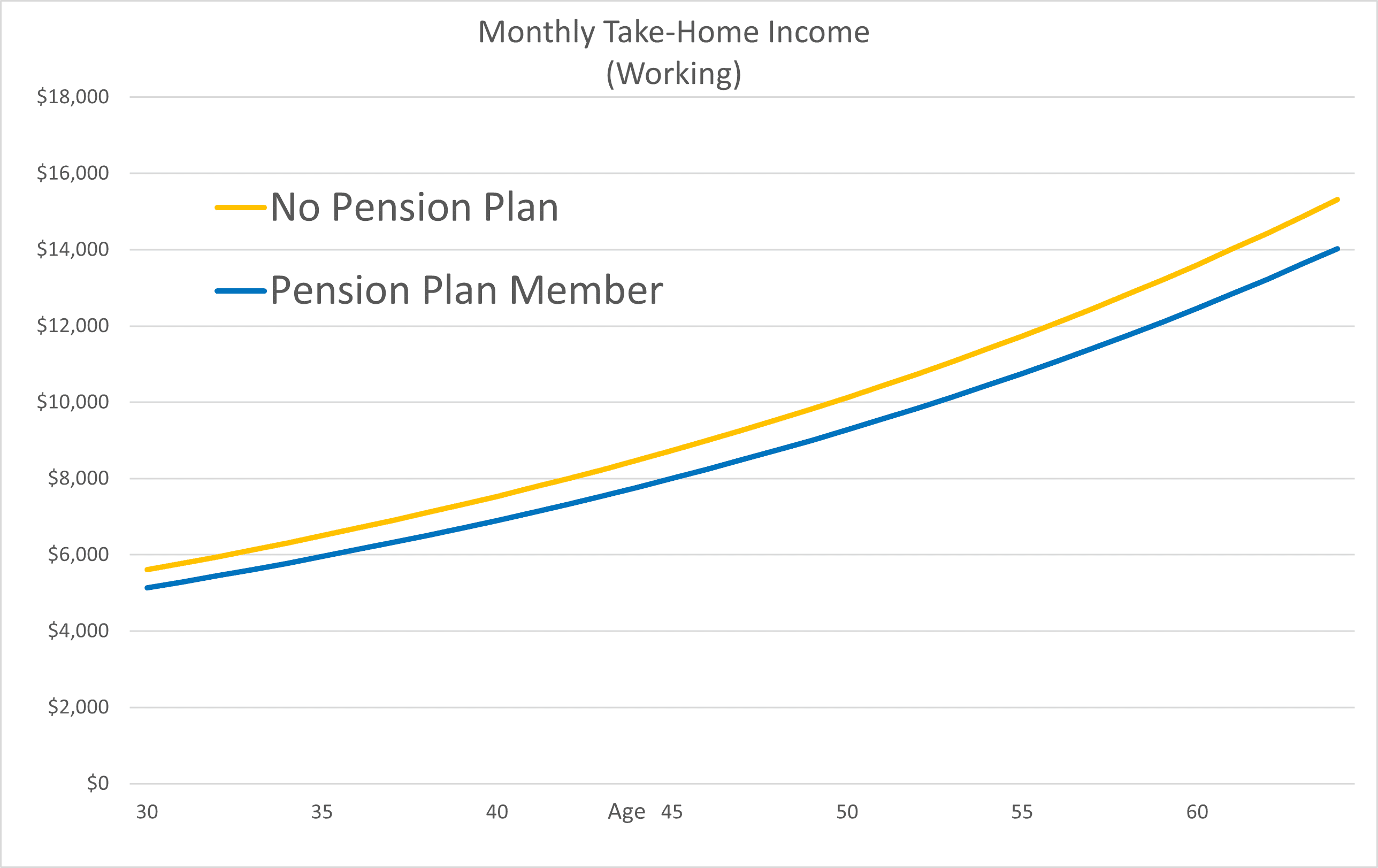

Let’s explore the financial differences between a 5% salary increase versus a 5% employer-matched pension contribution (10% total contribution) for an in-demand, skilled worker earning $80,000 annually who already gets regular annual increases of 3%. Concerned about retention, the employer wants to know: what is the most effective way to spend the additional 5% in compensation cost?

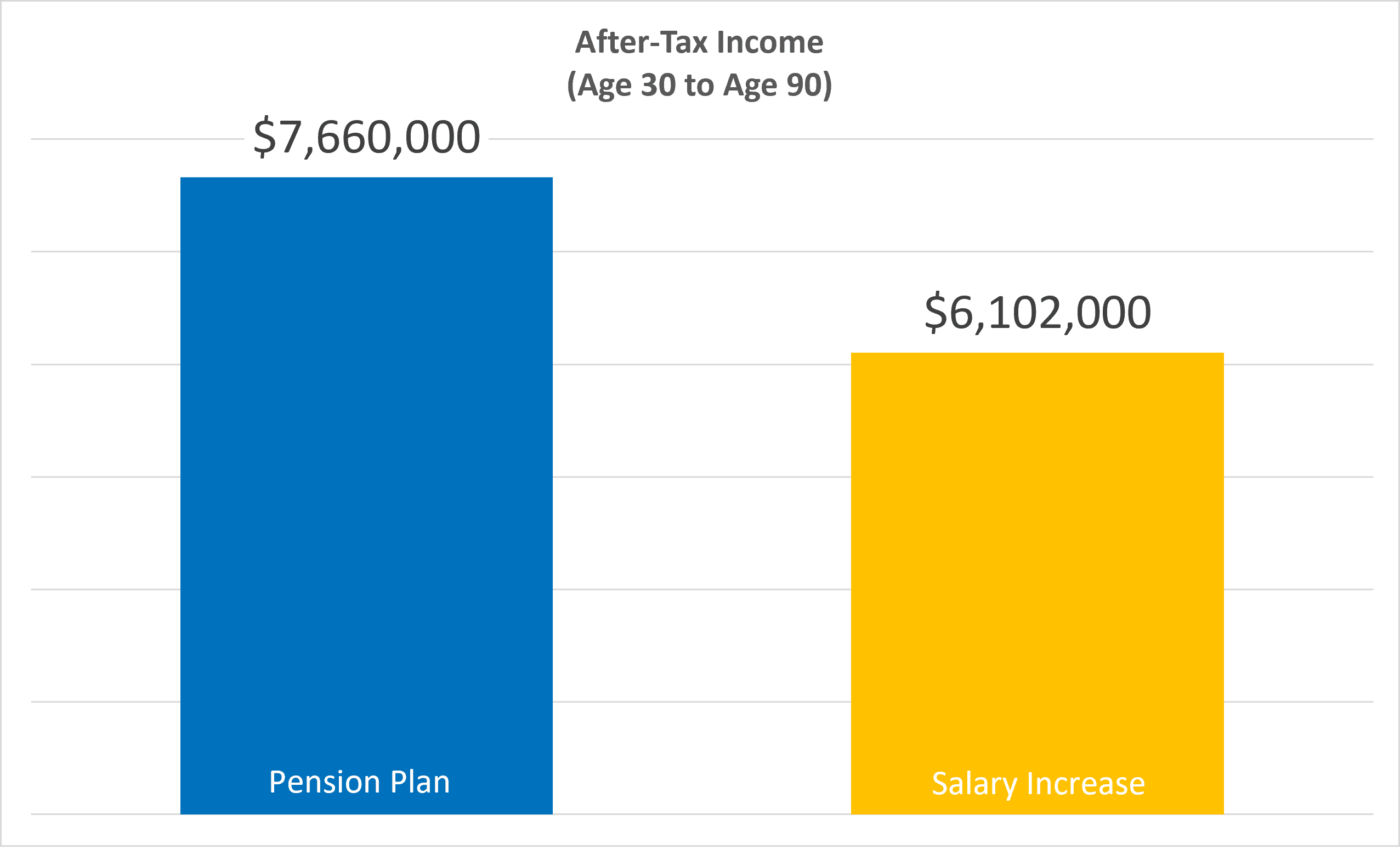

- Take-home lifetime income increases $1,588,000

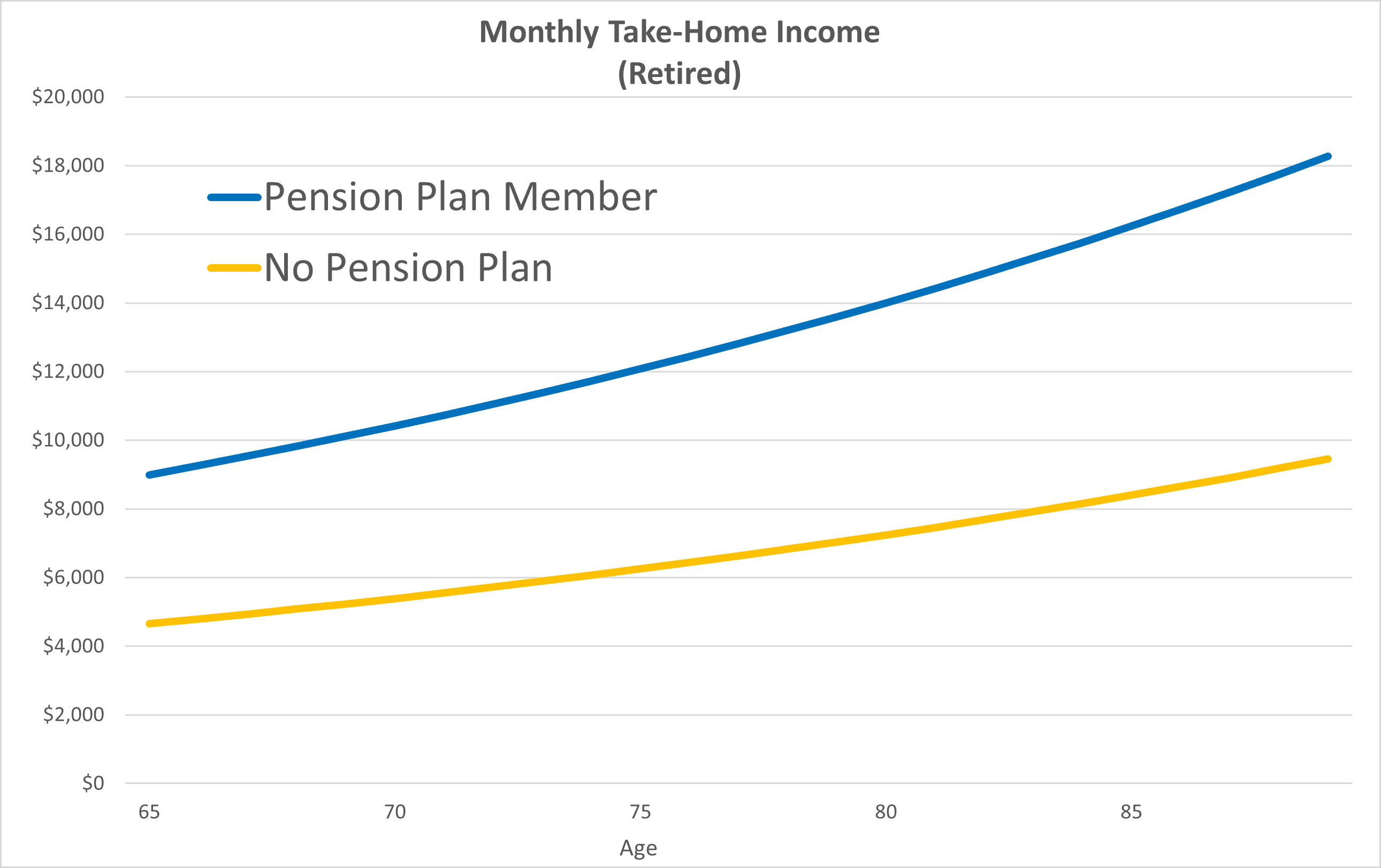

- Take-home retirement income increases 93%

For this scenario, we assume as follows: the worker is 30 years old, retires at 65, and lives until 90. Inflation is 3% and the net return on pension contributions is 5.5%. The worker gets maximum OAS benefits and 75% of maximum CPP benefits during retirement.

Advantage: Pension Plan

How does the pension plan perform for the employee? The numbers tell the story…

1. Higher Lifetime Income

The matched 5% pension contribution increases the employee’s lifetime pre-tax income by nearly $2 million, as compared to an equivalent salary increase. Even more impressively, lifetime take-home income rises by almost $1.6 million. This happens despite the employer’s cost being almost the same – it’s actually lower thanks to payroll tax savings.

2. Boosted Retirement Income

With the pension plan, the employee’s take-home retirement income increases by 93% compared to the salary-increase scenario, providing much greater financial security and a higher quality of life during retirement.

Why the Pension Plan Wins: It’s About Taxes and Performance

The advantage a pension contribution over a salary increase boils down to three key factors: 1) deferral of tax on contributions and investment returns; 2) lower tax rates in retirement; and 3) institutional-grade performance.

1. Tax Deferral – How It Works

Employer and employee contributions to a pension plan are tax-deductible. For a worker earning $80,000, this means immediate tax savings of 30% or more, depending on the province. Additionally, compound investment earnings on pension contributions grow tax-free, resulting in significantly more retirement savings.

2. Lower Tax Rates in Retirement

While working, our example worker faces a combined federal/provincial average tax rate of about 20%. In retirement, the average tax rate drops to 13%, not including additional savings from federal and provincial age and pension-income tax credits. By deferring receipt of income (increased by compounded investment returns) until retirement, the employee enjoys permanent tax savings and a higher lifetime take-home income.

3. Institutional-Grade Performance

While some tax benefits are available with RRSPs, pension plans with institutional asset management supervised by independent fiduciaries consistently outperform RRSPs, delivering better risk-adjusted returns for a lower cost. Fees and investment returns matter greatly: over a career, a 1%-2% difference can result in 20%-40% more (or less) retirement income.

The Employer Perspective: Win-Win

For employers, offering a high-quality workplace pension program instead of a salary increase has major benefits:

1. Employee Attraction and Retention

Rare in today’s workplace, a pension plan is a uniquely valuable benefit. Employers offering pensions enjoy a significant advantage in attracting and retaining skilled employees, who put a premium on pension plan membership. The results? More applications from qualified candidates, lower turnover costs, and a more engaged, loyal workforce.

Employees spend nearly 14 hours a week stressing about finances.

2. Greater Productivity

The impact of financial stress on employee productivity is substantial. According to one study, employees spend nearly 14 hours a week stressing about finances, with a third of employees reporting that financial stress inhibits their ability to focus. A good workplace pension program reduces financial stress, resulting in happier, more productive workers.

3. Lower Payroll Taxes

Salary increases – and even employer contributions to a group RRSP – increase payroll taxes. Pension contributions don’t. By diverting a portion of compensation and compensation increases to pension contributions, employers can permanently reduce their payroll tax bill. This makes pension contributions one of the most cost-effective ways to compensate employees.

Offering a pension plan is one of the most cost-effective ways to attract and retain top talent.

Blue Pier Makes Workplace Pensions Possible

Many small- and medium-sized business owners assume that offering a pension plan is too complex or costly. Blue Pier’s Pension Plan as a Service simplifies the process, allowing even small employers to provide an institutional-grade pension program with minimal administrative effort and risk. Contact us to learn how Blue Pier can help your business attract and retain top talent with a tailored pension solution that fits your needs.

Important Note

No one can predict the future or promise future financial outcomes. While the assumptions shown above are believed to be reasonable, actual outcomes of a workplace pension program may differ materially from the projections presented in this article.