Introduction

Most Canadians don’t think much about retirement at the beginning of their careers and don’t pay a lot of attention to how Canada’s retirement income system works – I know I didn’t, preferring to save money for travel rather than for retirement. That leaves most playing catch-up when they get to mid-career or even within sight of retirement age. That can be stressful.

It’s better to start saving early with a good understanding of how Canada’s “Three Pillar” retirement system works and how to make it work for you. That’s what this series is about.

The Three Pillars

Whether by choice or by necessity, everyone eventually stops working. When that happens, they will need sources of wealth (savings) or income to replace some portion of the salary or wages on which they relied to pay their living expenses while working. The amount they’ll need depends on the standard of living they want to maintain in retirement, and on anticipated (and unanticipated) aging-related expenses. Living expenses tend decline with age, so a retirement-income “replacement ratio” of 50 to 70 percent of pre-retirement working income has traditionally been regarded as sufficient to maintain a standard of living after retirement that is similar to working life. Today, however, 50-70% may fall well short of the mark.

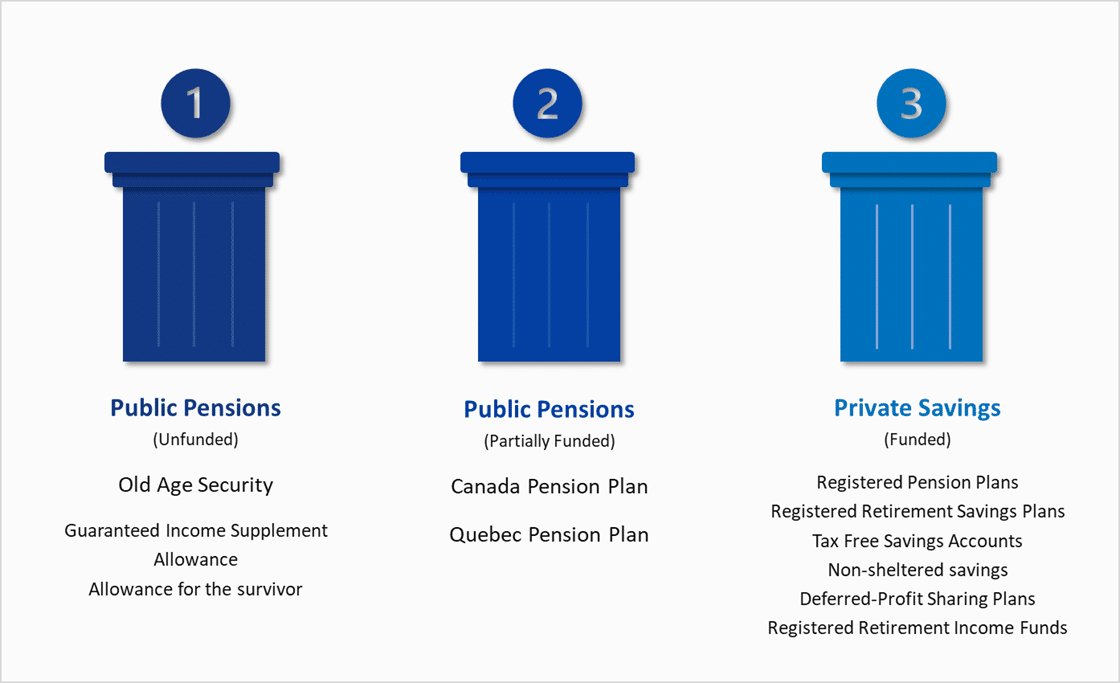

Like many developed countries, Canada’s system of income replacement for retired workers is comprised of a mix of public- and private-source income and wealth. This “three-pillar system” is described in different ways; for example:

- Some stakeholders put public programs like Old Age Security (OAS) and Canada/Quebec Pension Plan (C/QPP) in the Pillar 1 bucket, employer-sponsored workplace plans in Pillar 2, and personal RRSP, TFSA and non-sheltered savings in Pillar 3. This approach effectively makes Canada a two-pillar system for most of the workforce because Canadian employers are not required to offer pension or other group retirement plans, and most don’t.

- Government and policy-advocacy stakeholders (e.g. Service Canada, Library of Parliament, and ACPM) most typically put the public and compulsory programs in the first two pillars: the unfunded OAS program system is Pillar 1 and the partially-funded, compulsory C/QPP system is Pillar 2. Pillar 3 is comprised of all funded, private and non-compulsory options including employer-sponsored pension plans, group RRSPs, TFSAs and non-sheltered savings. This approach highlights important distinctions among funding approaches, risks, participation criteria and tax treatment.

Following is a brief description of the Three Pillars and each off their constituent elements.

Pillar 1: Old Age Security (OAS)

Paid from general tax revenues, OAS benefits are income-tested, inflation-indexed and available to Canadian residents 65 years of age or older with 10 or more years of residency. The basic OAS  pension 2024 for a 65-year-old retiree is $713 monthly and 10% more for a 75-year-old. Benefits are reduced for those less than 40 years of residency in Canada after age 18.

pension 2024 for a 65-year-old retiree is $713 monthly and 10% more for a 75-year-old. Benefits are reduced for those less than 40 years of residency in Canada after age 18.

The Guaranteed Income Supplement (GIS) of the OAS component provides low-income seniors up to $1,605 of additional benefits. The Allowance and Allowance for the Survivor components of the GIS provide temporary pensions from age 60 to 64 for low-income spouses and surviving spouses of up to $1,354 and $1,615, respectively.

Pillar 2: Canada/Quebec Pension Plan (C/QPP)

Although C/QPP are different plans with different funds, benefits are identical. QPP contributions are higher though (12.8% vs. 11.8% for CPP) on earnings for basic benefits. This is due to differences in plan-demographics and fund performance. In 2024, the average monthly C/QPP pension is $758 and the maximum is $1,365. The C/QPP normal retirement age is 65 and the pension can start anytime between age 60 and age 70.

The basic target pension for CPP is 25% of career earnings up to the Year’s Maximum Pensionable Earnings (YMPE) after 40 years of participation. With “first additional” CPP contributions, this 40-year target increases to 33%. The YMPE, which increases with wage inflation, is $68,500 in 2024. Beginning in 2024 the 40-year target increases to 33% on a higher target called the “YAMPE” – Year’s Additional Maximum Pensionable Earnings. To fund this increase, employees and their employers will contribute an additional 8% on earnings between the YMPE and the YAMPE.

Pillar 3: Private Retirement Savings

For retirement at age 65 and assuming no other income, Pillars 1 & 2 pay a maximum annual benefit of about $27,550 and an average $24,400 in 2024. That won’t even pay the rent, so Pillar 3 savings are essential to supplement Pillar 1 and Pillar 2 income.

Personal circumstances vary considerably, which means the 50-70% ratio won’t work for everyone. A few retirees may not need 50% and others may need more than 100%. With housing costs and mortgage interest rates at historic highs, this is especially true for renters and those whose mortgage payments continue in retirement. As well, a higher retirement income supports continued or even increasing savings post-retirement, a prudent contingency plan for the majority of workers who will retire with no insurance coverage for supplementary health care and long-term care. Personal preferences and goals are important too. Many people may reasonably want to have a better standard of living in retirement as a reward for a lifetime of hard work. For them, the 50-70% guideline will be too low a target.

Personal circumstances vary considerably, which means the 50-70% ratio won’t work for everyone. A few retirees may not need 50% and others may need more than 100%. With housing costs and mortgage interest rates at historic highs, this is especially true for renters and those whose mortgage payments continue in retirement. As well, a higher retirement income supports continued or even increasing savings post-retirement, a prudent contingency plan for the majority of workers who will retire with no insurance coverage for supplementary health care and long-term care. Personal preferences and goals are important too. Many people may reasonably want to have a better standard of living in retirement as a reward for a lifetime of hard work. For them, the 50-70% guideline will be too low a target.

Conclusion – Get Started!

No one can retire well on Pillar 1 and Pillar 2 income. So, what should you do? Start your Pillar 3 saving now. Here are some pointers:

- Pay off debt. Debt repayment may not sound like saving, but it is. Paying down debt reduces your interest costs and puts more money in your pocket. Debt repayment delivers an after-tax return that often beats the return on other investments and best of all, it’s a risk-free return.

- People with pension plans retire better, so work for an employer that provides a good one. If your employer doesn’t offer a pension plan, find one that does and make sure you get the full benefit of all the employer-matched contributions available.

- Start a Tax-Free Savings Account and a Registered Retirement Savings Plan and contribute regularly. Even small contributions make a difference over time.

- Pay attention to fees! Higher-fee investments don’t necessarily perform better, and often underperform.

For more information about pensions and retirement saving, or to find out more about how to establish your own group pension program, get in touch with us at info@bluepier.ca.

Sources

https://retraite-retirement.service.canada.ca/en/learn/main-sources-of-retirement-income

“Public pensions aren’t intended to cover all your financial needs in retirement.”

Understanding the three pillars

https://hoopp.com/home/pension-advocacy/resources/understanding-the-three-pillars-of-retirement#

Three Pillars Alternative View

Canada’s Retirement Income System

https://lop.parl.ca/sites/PublicWebsite/default/en_CA/ResearchPublications/201940E

ACPM Principles for Mandatory Public Pension Plans

https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

Allowance

Allowance for the Survivor

OAS 2021 Actuarial Report

https://www.osfi-bsif.gc.ca/sites/default/files/2023-12/oas18-psv18.pdf

CPP Enhancement

CPP Payment rates

https://www.canada.ca/en/services/benefits/publicpensions/cpp/payment-amounts.html

OAS Payment Rates

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/benefit-amount.html

OAS/GIS Payment Calculator

https://estimateursv-oasestimator.service.canada.ca/en/results